Read the latest insights from Pamela Chung, Tricor’s Managing Director & Head of IPO of Hong Kong:

(Jul 20, 2020) [HKEJ - Pamela Chung]

Pamela Chung, Managing Director & Head of IPO of Tricor Hong Kong, was interviewed by Hong Kong Economic Journal to share her insights on the Hong Kong IPO market.

Here are the key highlights:

- HK can consider attracting more A-share companies to do the H-share listing so as to increase IPO candidates.

- The A-share companies already have track records and thus are comparatively easier to evaluate the quality.

- If the “A then H” healthcare IPOs are well-received by investors in Hong Kong, i-banks may look for more prospects in a similar sector and thus creating a trend on this type of IPO.

Above: Excerpt from the interview. Please read the full interview here.

-01.png?width=544&name=Pamelas%20interview%20-%20wealth%20360%20(Jun%204)-01.png)

(Jun 4, 2020) [TVB Finance - Wealth 360 - Pamela Chung]

Pamela Chung, Managing Director & Head of IPO of Tricor Hong Kong, was interviewed by Wealth 360 of TVB to share her insights on the Hong Kong IPO market. Pamela still has an optimistic outlook for the HK IPO market, despite the outbreak of COVID-19 pandemic.

Here are the 3 key highlights from Pamela:

- The majority of the “China Concept Stock” companies are likely to adopt a wait-and-see approach regarding a secondary dual-listing. There are many factors and uncertainties affecting a listing decision, one of which is the recent news on tightening US regulatory requirements.

- If the reform of the A share market is very efficient and effective to the extend of matching the HK market, then it will offer an alternative for the “China Concept Stock” companies, however some companies tend to prefer a HK/overseas listing in order to become “international”.

- There are other upcoming IPOs that may outweigh the secondary listing IPOs, such as biotech/health sector, consumer brands and property management.

Above: Excerpt from the interview. Please watch the full interview here.

(May 26, 2020) [HKIBC - Wealth Touch - Pamela Chung]

Pamela Chung, Managing Director & Head of IPO of Tricor Hong Kong, was interviewed by Wealth Touch of i-Cable to further share her insights on the Hong Kong IPO market under the COVID-19 pandemic.

Here are the 3 key highlights from Pamela:

- The effects on HK IPO market due to the recent reform of PRC listing rules & requirements.

- The successful results arising from the HK listing rules reform on Weighted Voting Rights (WVR) & pre-revenue biotech companies.

- The choice between a HK listing and a A share listing is a matter of alignment of corporate goals of companies planning for an IPO.

Above: Excerpt from the interview. Please watch the full interview here.

(May 21, 2020) [HKIBC - Wealth Touch - Pamela Chung] & [TVB Pearl - Inside Market - Pamela Chung]

Pamela Chung, Managing Director & Head of IPO of Tricor Hong Kong, was interviewed by Inside Market on TVB Pearl and Wealth Touch of i-Cable to share her insights on the Hong Kong IPO market.

Here are the 3 key highlights from Pamela:

- The news of HS Index taking into account WVR companies & secondary listing companies may encourage more companies to turn to HK as a listing platform, this is due to the fact that HSI companies / blue chips are components of long funds.

- The PRC stock exchanges are introducing reforms to attract technology companies and biotech companies, it may become an alternative destination if the US “China Concept Stocks” are planning for a home-coming listing.

- If we want to attract more companies to list in HK, we need to carefully manage our IPO brand, we may need to focus on good quality companies (not limited to big companies though) while forgoing some low quality listing candidates. This way we can increase valuation & turnover in the long run.

Above: Excerpt from the interview. Please watch the full interview here.

(Jan 18, 2020) [i-Money - issue 639 - Pamela Chung]

“Unicorns, companies with new economy concepts, are expected to launch their IPO in the Hong Kong market. Given the successful story of Alibaba’ dual secondary listing, there may be an upsurge of US Listed China concept stocks “homecoming” to the Hong Kong market. Many are looking forward to seeing which one will be the next “homecoming” China concept stock.”

Above: Excerpt from the article. Please refer to this link to view the article in full.

(Jan 04, 2020) [Economic Digest - issue 1992 - Pamela Chung]

“The performance of IPO share price is driven by supply and demand. There is a saying that small or tiny IPOs can see their share price doubling easily as small deals in general can be supported by local investors and thus unlikely to be impacted by global factors.”

Above: Excerpt from the article.

(Dec 27, 2019) [Sing Tao Daily - Pamela Chung]

“When forecasting the 2020 HK IPO, most people are focusing on the secondary listing of China concept stocks or international companies. This(secondary listing) is a new trend, but may not be dominating the IPO market, actually there is another new trend which is “H-share full circulation” IPO.

Mainland China encourages companies to op for full H-share circulation instead of a Variable Interest Entity (VIE) Lisirng vehicle. H share issuer companies are registered in PRC whereas VIE companies are registered in overseas. It is expected that some IPO candidates will be doing a H share full circulation IPO in 2020.”

Above: Excerpt from the article. Please refer to this link to view the article in full.

(Dec 24, 2019) [HK ONCC - Pamela Chung]

Above: Excerpt from the article. Please refer to this link to view the article in full.

(Dec 24, 2019) [Oriental Daily - Pamela Chung]

Above: Excerpt from the article. Please refer to this link to view the article in full.

(Oct 15, 2019) [Oriental Daily - Pamela Chung] Launching Hong Kong SAR 1st IPO App

Pamela Chung, Managing Director, Commercial of Tricor Hong Kong, was invited by Oriental Daily, to share Tricor's plan of launching the first IPO App in Hong Kong SAR, which helps Tricor's IPO clients as well as retail investors especially the segment preferring a self-service no handling fee IPO subscription channel. It is also an effort to assist the proposed transformation into an uncertificated market in a few years.

Above: Excerpt from the article. Please refer to this link to view the article in full.

(Oct 5, 2019) [iMoney - Pamela Chung] Mega IPO rarely exists nowadays

Pamela Chung, Managing Director, Commercial of Tricor Hong Kong, was invited by iMoney to share her insights and pointed out that the current IPO market is worse than after the 2008 financial crisis. In 2008, many big mainland companies were planning to list in Hong Kong SAR regardless of the macroeconomic sentiment. Mainland Mega IPO rarely exists now, and the market seems to be quieter.

However, Pamela is optimistic that the market will bounce back. The key indicators of this are market sentiment and investor confidence. In the trend of the new economy, there are substantial opportunities for Hong Kong SAR in companies of good quality and with distinctive investment stories. When the long-term return of these companies proves stable, the investors' confidence will grow.

Above: Excerpt from the article. Please refer to this link to view the article in full.

(Aug 26, 2019) [Oriental Daily - Pamela Chung] Enhancing the transparency of the black out periods of the new stocks

Pamela Chung, Managing Director, Commercial of Tricor Hong Kong, was invited by Oriental Daily to share her insights on the lock-up period of IPO Cornerstone Investors:

”At present, many IPOs involving cornerstone investors have a lock-up period, but their prospectuses only state a 6-month lock-up period instead of providing a specific date. There have been recommendations to make voluntary company announcements informing public the exact dates when a lock-up period approaches its end.

However, I think that a company announcement may not be necessary. It may be more feasible to standardize market practices by stating the exact end-date or by specifying the exclusion of public holidays in the prospectus when defining a lock-up period.”

(2019年8月26日) [東方日報 – 財經] 新股禁售期倡增透明度

卓佳商務部董事總經理鐘絳虹應《東方日報》邀請分享她對列明新股禁售期屆滿確實日期的見解:

現時不少新股都會引入基石投資者,並對這些投資者的持股設禁售期限,惟招股書卻沒清楚列明屆滿日期。業界認為,在禁售期何時屆滿的披露上有改善空間,建議香港交易所可考慮要求公司在招股書列明禁售期屆滿的確實日期,又或在禁售期臨近屆滿前發出自願性公告提醒市場。

但她提到:「未必需要在屆滿日期或之前發出公告。反而,若可列明禁售期屆滿的確實日期,又或者列明公眾假期、周六、日不計等,可能會更加清晰,以及讓市場可按同一標準去計算。」

Above: Excerpt from the article. Please refer to this link to view the article in full.

(Aug 12, 2019) [HKEJ - Pamela Chung] IPO Queen advocates for uncovering New Economy IPOs

Pamela Chung, Managing Director, Commercial of Tricor Hong Kong, was recently interviewed by Hong Kong Economic Journal regarding opportunities and positioning of the Hong Kong SAR IPO market with the rise of Mainland Chinese unicorns and Star Market in Shanghai:

“Many emerging companies in Mainland China are IPO-ready and some of them are “unicorns” (valued at USD 1 billion or above), which will provide a wealth of IPO resources for Hong Kong. During a recent visit to Hangzhou, among the many young startups on their IPO journeys, their management team's vision, credibility and moral standard become all the more relevant, given their brief track records. While the Shanghai Star Market inaugurated recently on July 22, direct competition is less likely given that the Hong Kong IPO market allows for better listing timeline and post-listing re-financing. In addition, some Mainland Chinese municipal governments are having programs encouraging local companies to do IPOs – many of which are keen to explore the Hong Kong IPO market.”

(2019年8月12日) [信報 - 專訪] 新股女王倡發掘新經濟IPO

鍾絳虹指出,內地近年提倡創業創新,不少新興企業已發展至可上市規模,部分估值亦屆「獨角獸」(估值達10億美元或以上)級別,能為香港特別行政區提供不少IPO資源。

她特別提到,早前到杭州出席論壇及考察時,除見當地有不少發展不俗的新興企業外,其管理層對未來業務所抱願景亦令她留下印象,「新經濟股因為好多沒有往績支持,更重視管理層的信譽及道義,而不是只為了上市呃股東錢。」故她預料,這批公司縱使集資規模不大,但日後來港上市,仍足以吸引投資者青睞。

上交所科創板首批IPO於7月22日正式掛牌,市場擔心科創板將搶去香港有意吸納的內地新經濟IPO。然而,鍾絳虹不同意,因香港新股市場在掌握上市時間和上市後再融資兩方面,均優於科創板;加上不少企業仍較鍾情境外市場,如內地部分省市政府也積極鼓勵轄內企業赴港掛牌。

Above: Excerpt from the article. Please refer to this link to view the article in full.

(July 9, 2019) [Hangzhou News - Pamela Chung] Pamela Chung on New Economy Companies in Hangzhou

Pamela Chung, Managing Director, Commercial of Tricor Hong Kong, was interviewed by the online news platform Hangzhou News at the Overseas Chinese Elites Summit for Innovation and Entrepreneurship 2019 in Hangzhou. She commented on the trend of local new economy companies across the Zhejiang Province doing IPOs in Hong Kong SAR:

“At present, the market sentiment in Hong Kong is generally in favour of the new economy enterprises. Meanwhile, the thriving new economy in the city of Hangzhou and across the Zhejiang Province, supported by its extensive digital infrastructure, boasts many private enterprises which will continue to contribute a significant share to the Hong Kong IPO market as a leading driving force.”

(2019年7月9日) 【杭州網】聚焦資智融通 賦能杭港合作「杭港驛站」在杭授牌

在2019僑界創業投資高峰論壇上,卓佳集團董事總經理鐘絳虹應邀分享她對今年有關杭州與香港合作的主題的見解。她接受杭州網訪問時表示:「當前,香港金融市場更加看好新經濟領域的企業,杭州以數字經濟為主導的新經濟充滿活力,相信未來杭州乃至浙江的民營企業會成為香港金融市場的生力軍。」

Above: Excerpt from the article. Please refer to this link to view the article in full.

(July 9, 2019) [Ta Kung Pao and Wen Wei Po - Pamela Chung]

IPO Queen Pamela Chung: New Economy Companies Remain in Favour for the Hong Kong SAR IPO market

At the Overseas Chinese Elites Summit for Innovation and Entrepreneurship 2019 in Hangzhou, Pamela Chung, Managing Director, Commercial of Tricor Hong Kong, was invited to share her insights with this year’s theme on greater Hangzhou-Hong Kong SAR cooperation, in particular to encourage and promote more companies to list in Hong Kong SAR.

She sat down for an interview by Ta Kung Pao and Wen Wei Pao to share her insights on the IPO listing, investment and overall macroeconomic trends in Hong Kong SAR:

“Over the years, Hong Kong has always been regarded as the IPO fund-raising centre which benefits from giant PRC corporations and state-owned enterprises. The mega IPOs in the financial and insurance sectors have long been regarded by Hong Kong investors as good investments with dividend distribution. Currently, a lot of those big corporations have already become listed, and the trend is now towards medium-sized IPOs, in particular the new economy companies. Despite the macroeconomic uncertainties, Hong Kong investors are always keen to sniff out investment opportunities and remain unaffected by any non-market factors, once they regard an IPO as a good buy. Going forward, good companies in the new economy sector are believed to remain in favour for the Hong Kong IPO market.”

(2019年7月9日) 【大公報及文匯報】「新股女王」鐘絳虹:港股青睞新經濟企業

在2019僑界創業投資高峰論壇上,卓佳集團董事總經理鐘絳虹應邀分享她對今年有關杭州與香港特別行政區合作的主題的見解,特別是鼓勵及推動更多公司到香港特別行政區上市。 她接受大公報及文匯報的採訪,分享自己對香港特別行政區IPO、投資與整體宏觀趨勢的見解:

鍾絳虹接受訪問時表示,過去很多年,香港都是全世界IPO融資額最高的地方,其實是受惠於國內的超大型企業紛紛赴港上市,例如銀行、保險這些金融的、實體的、重資產的企業。儘管宏觀經濟環境充滿不確定性,但相較於傳統企業,新經濟企業在私募融資市場會繼續獲得投資者青睞。如果有好的企業來香港IPO,投資界的人還是會去尋找賺錢的機會。

Above: Excerpt from the article. Please refer to this link and this link to view the articles in full.

(Jun 24, 2019) [Oriental Daily - Pamela Chung] Prudent outlook for Hong Kong SAR IPO market in the upcoming half year | IPO Queen: Reviews needed to improve attractiveness for Hong Kong SAR as the IPO destination for European and Asian companies

Pamela Chung, Managing Director, Commercial of Tricor Hong Kong, was invited by Oriental Daily to share her insights on the Hong Kong IPO market performance so far this year, and on why Asian and European companies are having reservations when considering a Hong Kong SAR listing in the form of HDR:

The 2019 Hong Kong SAR IPO market performance so far has fared worse comparing to same time last year. Although many companies have already been preparing for their IPO listings, they tend to hold back their submissions given current market volatilities. However, if the widely-speculated technology giant is indeed doing a second listing in Hong Kong SAR, it may help boost the total fund raised in this year’s Hong Kong SAR IPO market.

Meanwhile, companies from certain countries can only do a Hong Kong SAR listing in the form of HDR. There have been ongoing inquiries about IPO listing in Hong Kong SAR from companies incorporated in South Korea and Germany, for example, but they expressed reservation over HDR, due to its low liquidity. Therefore, if they were allowed to do a direct listing in the form of shares, rather than HDR, it would help attract more Asian and European companies to consider doing an IPO in Hong Kong SAR.

(2019年06月24日) 【東方日報】 IPO市場下半年料審慎 | 港難吸引歐亞公司來港上市 新股女王︰宜檢討指引

卓佳商務部董事總經理鍾絳虹回顧今年上半年新股市場表現時表示,整體表現較去年同期差。展望下半年,市場繼續受貿易戰等負面因素影響,保薦人及企業態度審慎。至於下半年新股市場表現,她預期繼續受不明朗因素影響,保薦人及企業態度審慎。「好多企業雖然已做好上市準備,但態度觀望,未提交上市申請。不過,若市傳的某科網巨企落實來港第二上市,可有助帶動今年香港新股集資額。」

鍾絳虹接受訪問時表示,多年以來都有外國公司查詢來港上市,包括南韓及德國註冊的公司,但發現來港上市有難度。「未上市前,外國企業的法律顧問都會先查詢,但參考港交所的南韓及德國上市地區指南,發現只考慮以HDR形式上市。」她直言,很多潛在客戶知悉之後,都對來港上市打退堂鼓,主要是因HDR在港成交向來欠活躍。

香港特別行政區過往曾有多隻HDR上市,包括Coach、思佰益、淡水河谷等,但最終均除牌收場,現時HDR只剩下迅銷(06288)。她直言:「有些客戶認為迅銷品牌大,但HDR成交亦一般,何況是其他發行人,成交豈不是更差?況且,企業上市亦要不少使費及有持續的上市後費用。若要企業重組更改註冊地亦涉及稅務成本,故海外公司都不願意以HDR形式在港上市。」

鍾絳虹直言,亞洲市場中,日本及南韓有大量潛在來港上市的公司,但HDR卻難以吸引這些公司來港,故希望有關方面可解決有關事宜。

Above: Excerpt from the article. Please refer to this link and this link to view the articles in full.

(Jun 17, 2019) [Oriental Daily - Pamela Chung] China Concepts Stocks Unlikely to Have Large-scale Retreat from the US Market: Consider Second Listing in Hong Kong with a Close Eye on US-China Trade Issues

Pamela Chung, Managing Director, Commercial of Tricor Hong Kong, was invited to comment on Hong Kong Economic Journal regarding the effects on the US listing of China Concept Stocks under the recent US-China trade issues —and how Hong Kong SAR may be welcomed as the destination for secondary listing.

She commented that amid the US-China trade issues, many companies will continue to keep a close eye on the market developments and may consider getting secondary-listed in Hong Kong SAR. The high ongoing compliance costs involved on any dual-listing, however, may add another layer of difficulty for small and medium-sized enterprises.

(2019年06月17日) 【東方日報】IPO市場下半年料審慎 | 港難吸引歐亞公司來港上市!新股女王︰宜檢討指引

中美貿易戰持續發酵,有美國國會議員先後提出法案,要求中概股遵守美國監管規定,否則應被除牌,多達逾800家中港公司受影響。卓佳香港商務部董事總經理鍾絳虹相信,公司會觀望中美貿易戰形勢,以及頭數宗來港第二上市的表現再作決定,惟中小企料難維持兩地上市的高昂合規成本。

Above: Excerpt from the article. Please refer to this link to view the article in full.

(April 23, 2019) [Oriental Daily - Pamela Chung] Hong Kong SAR In The Top 3 Worldwide for Biotech IPO Listing

With Hong Kong as No. 3 in the world in attracting biotech companies for their IPO listing, Pamela Chung, Tricor’s Managing Director, Commercial, Hong Kong, was invited to comment on its success and HKEX’s introduction of the WVR listing regime a year on since April 2018:

“Allowing companies with weighted voting rights (WVR) to get listed in Hong Kong in the past year has benefited the city with a new window of opportunities. Their significant IPO volume and market-indicatory transactions have played an outstanding role in raising Hong Kong’s IPO ranking with remarkable promotional effect on the city. While it is all subjected to market sentiments whether even more WVR companies will choose Hong Kong, it is sure to facilitate investors’ profit-making opportunities.”

(2019年04月23日) 【東方日報 – 財經】港吸生科企上市膺三甲

有「新股女王」之稱、卓佳香港商務部董事總經理鍾絳虹表示,容許WVR公司在港上市,就如打開「一扇窗口」給那些同股不同權、市值大的公司來港上市,這些公司集資額大、具指標性,同時能夠推高香港在全球新股集資額排名,並且帶來市場推廣效應,「但這個窗口會不會吸引更多WVR的大公司來港上市,很視乎市場變化,歸根究柢都要能令投資者有錢賺!」

Above: Excerpt from the article. Please refer to this link to view the article in full.

(Mar 28, 2019) [TVB Pearl – Inside Market (Putonghua)] Interview with Pamela Chung

Pamela Chung, Tricor’s Managing Director, Commercial, Hong Kong, was invited for an interview by Program Host Ms. Pan Zi-ling on the live Putonghua financial program Inside Market. Highlights of the interview are as follows:

IPO Outlook and Theme and for 2019:

It is difficult to tell with certainty at this moment projections for the coming year, but it is not impossible to see big brands and notably sized companies eyeing for a listing in Hong Kong SAR which may help heat up market sentiments. For the first quarter, it has been more about projects carried on from last year which got delayed because of market uncertainties.

Recognition by the market as the IPO Queen:

Pamela’s recognition as the IPO Queen came not from her employers nor herself, but through her extensive track records built during the years when many of the mega PRC SOEs (state-owned enterprises) went overseas for a cross-border listing, such as a HKSAR and US dual listing.

For a long while, Pamela has been involved in those mega IPOs with a complicated settlement requirement, for example an A+H simultaneous dual listing can involve complicated logistics, compliance requirements and a careful timetable – and without any precedent. Having participated more than 600 IPOs to this day, Pamela has become the one to turn to whenever IPO legal advisers, investment bankers and other industry practitioners have questions about IPOs.

Streamlining the IPO process:

Regarding the reduction of the IPO settlement cycle, it would not be difficult to get market consensus with minor adjustments on the local systems in Hong Kong SAR, such as discussions on fund clearing dates with banks and brokers. It is also noteworthy that Hong Kong SAR is the only market in the world allowing retail investors to subscribe for IPO shares via a number of subscription channels.

Yet with the current T+5 timetable, which the listing date is behind the pricing day by five trading days, shortening of the IPO settlement cycle (such as T+3) is only workable later with the implementation of paperless regime.

Suggestions for Hong Kong SAR to increase adaptability and competitiveness:

There is no doubt that certain companies may be attracted to the newly introduced Technology Innovation Board on the Shanghai Stock Exchange. Yet, up till today, international companies and certain joint ventures set up by PRC companies and international companies will still consider Hong Kong SAR and value its springboard status.

Capital markets depend heavily on timing. There are two main types of companies which will continue to be the driving force. First, international companies with PRC business looking for PRC partners. Second, PRC companies with overseas investments or overseas M&As may consider IPOs in Hong Kong SAR.

Differentiation helps diversify the unique edge and springboard status of Hong Kong SAR’s global IPO crown as complementary to the Mainland Chinese Boards. HKEX recently released their Strategic Plan 2019-2021 with one of the key initiatives as Global Connection, which helps define a new theme for this year’s IPO: international companies.

(2019年3月28日)【交易直播室(普通話)】卓佳香港商務部董事總經理鍾絳虹專訪

卓佳香港商務部董事總經理鍾絳虹獲邀接受「交易直播室」主持潘姿伶訪問,分享她對香港特別行政區在全球IPO市場中的角色的最新見解:

2019市場前景和主題:

鍾絳虹指出,目前暫時難以準確估計來年走勢,始終目前第一季完成的IPO項目都是承接去年因市況不明朗因素而順延至今年上市的企業,但相信年底前相信有機會見到大型企業來港上市帶動大市氣氛。

獲冠以「IPO Queen(新股女王)」美稱的原因 :

鍾絳虹多年來參與至少600隻新股上市,深獲客戶及業界信任,行內冠以「IPO Queen(新股女王)」的美稱。適逢內地龍頭國企在美國和香港特別行政區同步上市,當時未有先例說明如何處理,但接手後便立下先例,包括較為棘手、A+H股同時上市的案例,累積豐富經驗。印刷招股章程時的行家,以至投資銀行家、律師及其他專業服務人士,後來每當遇上問題新股上市,都會先請教她的意見,稱她為「IPO Queen(新股女王)」。

無紙化證券市場簡化新股發行流程:

要減省新股發行的所需時間,讓香港特別行政區業界達成公識、制度上稍作改動並非異常困難的事。但前提是,要等待無紙化證券市場實施後,IPO不用再發行紙本證券,便或可減少結算時間。以目前新股的T+5結算週期計算,鍾絳虹認為最終結算期或能減至T+3。

讓香港保持競爭優勢的建議:

上海科創板等內地證券交易所對部分有意上市的企業無疑別具吸引力,但直到今時今日,香港特別行政區仍然擔當「跳板」的角色,被國際企業或內地公司與國際企業的合資企業視為上市第一選擇。

資本市場看的都是時機,因此目前來港上市的企業主要分兩種:尋找內地合作伙伴、在內地鋪設網絡的國際企業,以及積極於海外合併或海外投資的內地企業。

作為2018年 IPO 集資金額高踞全球榜首的香港特別行政區,要保持獨特優勢和跳板地位,並與內地市場互相補足、實現差異化對香港特別行政區來說尤其重要。香港特別行政區交易所公佈的《戰略規劃2019-2021》,其中一項焦點主題是進一步擴大國際業務,因此國際企業將是香港特別行政區今年的IPO 的新主題。

(Jan 28, 2019) [Scripless IPO Consultation] IPO going all scripless: deadline soon imposed on physical scrip

(Jan 29, 2019) Joint consultation by HKEx and SFC: physical scrip soon becomes history – HKEx plans to go all scripless

- Pamela Chung, Tricor’s Managing Director, Commercial of Hong Kong, was quoted on Apple Daily. She shared her perspective on scripless IPOs and the current T+5 mechanism, where the listing date is behind the pricing day by five trading days.

- When asked whether scripless IPOS can shorten the T+5 timetable, Pamela commented, “With regard to the shortening of IPO settlement cycle, the current T+5 timetable is set up not only due to paper application, but also due to the clearing time of application monies. If brokers and custodians can guarantee the fund on their clients’ application monies, then the timetable can be speeded up by 1 more day. In my view, T+3 would be doable under the proposed structure, but T+2 would be difficult to achieve.”

(2019年1月28日) 【無紙化諮詢】新股不再有紙本證券 現持實物股票將設限期

(2019年1月29日) 港交所證監會聯合諮詢 實物股票將成歷史 港股擬推無紙化

- 紙本實物股票將會成為歷史!港交所(388)、證監會及證券登記公司總會進行聯合諮詢,為在港實施無紙化證券市場提出具體方案,其中IPO將不再發行紙本證券,或可減少一日結算時間。另外,投資者手上的實物持股亦將設限期。

- 發行新股不再提供紙本選擇,是否能縮短新股的T+5結算週期,拉近定價與掛牌日?卓佳董事總經理、「新股女王」鍾絳虹稱,結算週期除視乎申請實物白表IPO的投資者數目外,技術上新股申請的託管人如能保證申請資金,則可減少一日的結算時間,她認為最終結算期或能減至T+3,減至T+2較難做到。

Above: Excerpt from the article. Please refer to this link and this link to view the articles in full.

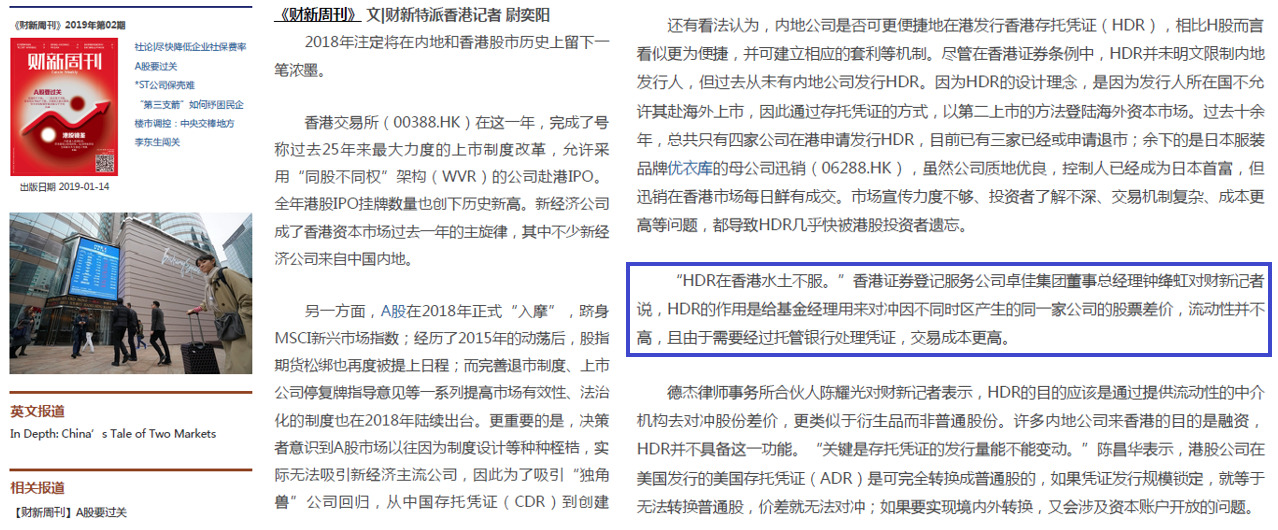

(January 14, 2019) “China’s Tale of Two Markets” on Caixin Media – Pamela’s insights on HDR

Pamela Chung, Tricor’s Managing Director, Commercial of Hong Kong, was quoted on Caixin Media, a leading Chinese business media. She shared her perspective on why Hong Kong Depositary Receipt Framework (HDR) is less assimilated to the Hong Kong market, comparing the phenomenon to “plants not accustomed to certain climates”. Pamela, an expert of IPO investor services, was among the leading industry figures ranging from fund managers, private equity companies to law firms invited for the interview.

(2019年01月14日) 《财新周刊》 2019年第02期 港股镜鉴

“HDR在香港水土不服。”香港证券登记服务公司卓佳集团董事总经理钟绛虹对财新记者说,HDR的作用是给基金经理用来对冲因不同时区产生的同一家公司的股票差价,流动性并不高,且由于需要经过托管银行处理凭证,交易成本更高。

Above: Excerpt from the article. Please refer to this link to view the article in full.