Out of adversity often comes opportunity, something that is increasingly apparent as we head into the final stages of the year. However, rather than stifling progress, the pandemic-related events of 2020 are helping to fast-track China's economic development.

As the country gradually recovers, we see a greater focus on what is termed the 'dual circulation' economic model. As its name suggests, the strategy has two interlinked objectives: the first is to improve the global value of Chinese businesses by shifting focus away from low-cost manufacturing toward high-end sectors, such as technology. The second element of the strategy will see the wealth these firms generate feed back into the domestic economy, which should support people's incomes and boost their spending power.

The core thinking behind dual circulation isn't new. Over the past couple decades, China has been rebalancing its economy away from an export-led trajectory toward one that is propelled more by domestic consumption. What the pandemic has done is add momentum to the process.

Greater than the sum of its parts

For any such repositioning to work correctly, it requires a powerful engine. The establishment of the Guangdong-Hong Kong-Macao Greater Bay Area (“GBA”) in 2017 gives China the economic motor it needs to drive the next stage of its development.

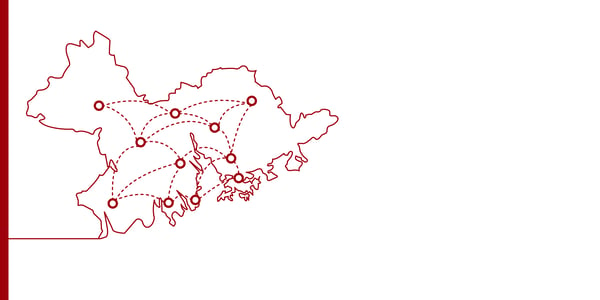

The GBA comprises of nine major cities in Guangdong Province plus the two special administrative regions of Hong Kong and Macao. The combined zone, which is among the most economically open in China, has a population of over 70 million and a GDP of US$1.68 trillion[1].

Within the framework of the GBA, Hong Kong will play a central role as a so-called super contact. In other words, as an essential bridgehead for dual circulation. Hong Kong offers financial and capital advantages, plus rich experience in legal, accounting, trade, and consulting. Hong Kong can extend its international contacts and expertise to mainland China, helping introduce foreign capital. It can also jointly explore overseas markets and opportunities with mainland enterprises.

Companies must to play their part too

With the economic blueprint established, businesses will need to formulate and implement appropriate strategies, particularly in areas such as enterprise management, risk control and human resources. By doing so, they can grasp the vast opportunities brought about by the rise of the GBA – interconnection and the free movement of goods, services, talent, and information.

Joe Wan, CEO of Tricor Hong Kong, explains: "The various cities in the Greater Bay Area have different development orientations, regional patterns, and economic strengths. Diversity helps businesses to flourish as well. For example, we have Hong Kong's financial industry and free port, Shenzhen's finance and technological innovation, Guangzhou's commerce and logistics, Zhongshan's cultural tourism, and Huizhou's manufacturing industry."

Joe adds, "Many companies focus on the second, third, and fourth-tier cities in their domestic business expansion. So they are particularly optimistic about the economic potential of the Greater Bay Area as a docking zone for domestic and foreign systems, regulations, and markets."

In addition to having one country with two systems, three tariff areas, and four core cities under the GBA umbrella, there are also three types of currency in circulation and different legal systems. They combine to form a unique pattern.

Understanding the risks

Besides regional integration, it's worth bearing in mind the outward aspects of dual circulation. The success of the strategy will be guided by the professional implementation of Chinese enterprises expanding overseas. In international trade and economic cooperation, the global compliance environment that Chinese enterprises face is more complex, and the laws and regulations of international, regional, and investment target areas must be taken into account.

It is vital, therefore, that Chinese firms understand and comply with the laws and regulations of each target country; otherwise, they risk losing control over elements of their operating structure. Of course, these risks are not unique to Chinese companies; they exist in some form for all enterprises looking to grow, regardless of geography.

A recent study also revealed some growing pains in the GBA, with an uneven distribution of resources between the various cities, a lack of investment in technology research, and issues with the standardization of rules and regulation. However, given the scale of the GBA and its objectives, none of this was unexpected. These issues are already on the government’s radar and we can expect them to be progressively resolved.

Geography and policy

When set against a backdrop of geographical advantages and preferential policies, the GBA is going to play a vital part in the dual-circulation model. Crucially, the GBA building blocks were already in place before the pandemic. So, rather than having to build up the country's economic future, the authorities and businesses can instead focus on building it out – with the GBA serving as the launchpad for reaching the next stage of the country’s economic journey.