- Solutions

- About

- Success Stories

- Careers

- Blog & News

- Contact

Japan

Government Stimulus

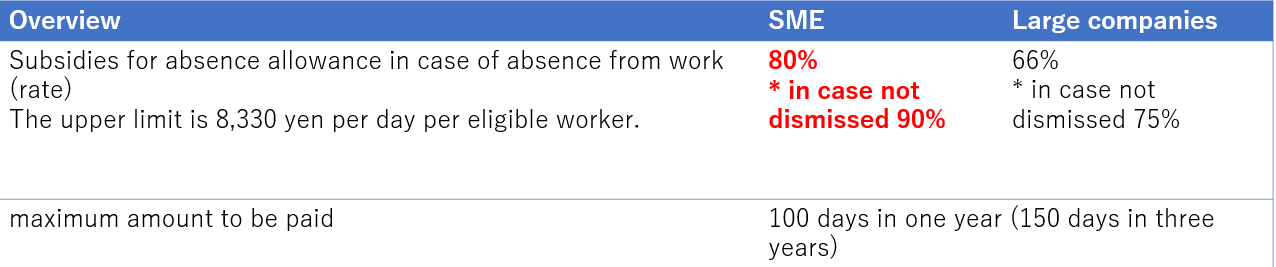

1. Employee Absence Grant

Employees are temporarily absent from work due to the new coronavirus, and a portion of the allowance is subsidized by providing them with an absence allowance.

Conditions

- Employers affected by new coronavirus infections

- Business turnover or production decreased more than 5% in the last 1 month compared to last year

- Documented absence agreement between company and employee

- Submit “Absence Implementation Plan” by 30 Jun 2020 for first absence between 24 January 2020 to 23 July 2020.

- Business that pays absence allowance in accordance with Labor Standards Law

- Absences of workers not insured by employment insurance are also covered.

Subvention of 1,280,000yen

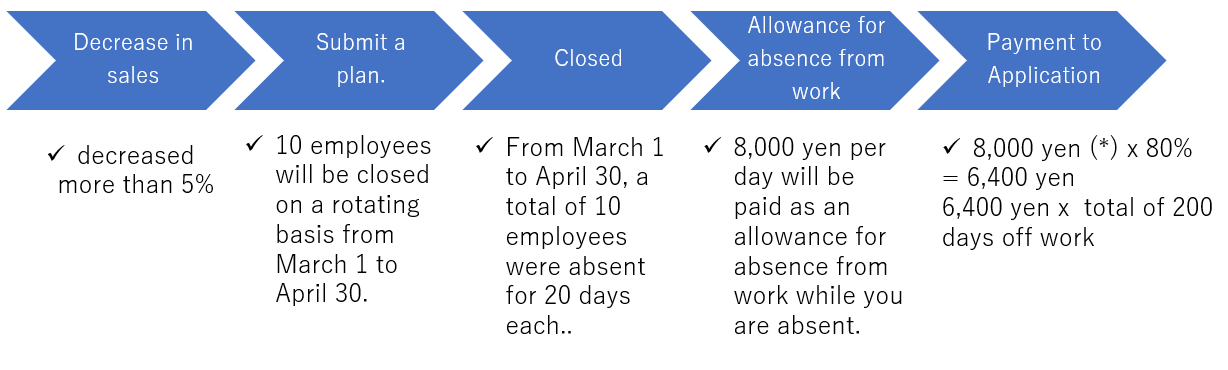

2. Subsidies to support parental leave for temporary school closures, such as elementary schools

As a measure to prevent the spread of the COVID-19, when elementary schools, etc. are temporarily closed, the subsidies are provided to companies that allow workers who are the guardians of children attending those schools, etc., to take paid leave in addition to the annual paid leave under the Labor Standards Act, in order to deal with the decrease in income associated with the leave.

Conditions

An employer that allows workers who are required to take care of a child under (1) or (2) to take paid leave (full wage payment) separately from the annual paid leave under the Labor Standards Act.

- As a measure to prevent the spread of new coronavirus infection, children attending elementary schools and other schools that were temporarily closed

- Children attending elementary school who are at risk of being infected with COVID-19, such as cold symptom.

Vacation days: 27th on Feb 2020 to 30st on Jun 2020

Definition of an elementary school: Elementary schools, nursery schools, kindergartens, compulsory schools (elementary courses only), special needs schools (up to high school)

There are after-school children's clubs, certified children's kindergartens, etc. Junior high and high school are not eligible.

Loans

- 1. Benefit 300,000 yen

- Benefit Maximum 2,000,000 yen for SMEs

- Interest-free and unsecured

【 National Life Business 】Outline of the Special Loan for New Coronavirus Infections

Who

1.Sales in the last one month have decreased by 5% or more compared to the same period of the previous year or two years ago,

2.Business for more than 3 months but less than 1 year and 1 month, your sales in the last 1 month have decreased by 5% or more compared to either of the following

(1) Last 3 months (including the last 1 month) Average sales

(2) Sales in December of 2019

(3) Average sales from October to December of 2019

How to fund

Business conditions are expected to recover and develop over the medium to long term.

Use of funds Capital and long-term working capital required by social factors associated with the impact of the new coronavirus infection

Maximum loan amount

National life business: Direct loan 60 million yen (separate line item)

Interest rate (years)

Base rate (of interest),However, up to 100 million yen is the base interest rate of -0.9%(Note 1) for the first three years of the loan, and the base interest rate for the fourth and subsequent years. more information on "virtually interest-free".

Actual repayment period

Within 20 years (including a deferment period of 5 years or less)

Working capital Up to 15 years (including a deferral period of up to 5 years)

Collateral, etc.

Unsecured; interest rate review system every five years.

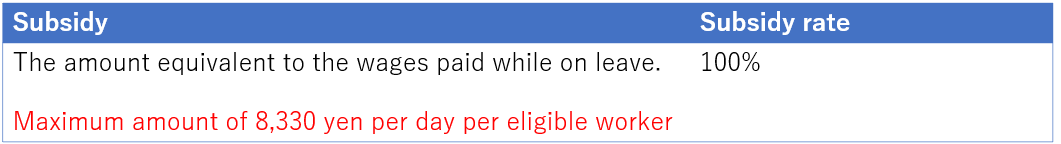

Apply for a loan

Direct loan, or apply at the SME business counter of any JFC branch.

[Natural life business]

Application procedures for the "Special Loan for New Coronavirus Infections"

Currently, the government is considering a special interest subsidy system, and those who meet certain requirements can receive interest subsidies at virtually no interest for the first three years, up to 30 million yen. Please wait for a while until the details of the specific procedure for claiming the interest subsidy are made public. Please note that we may not be able to meet your wishes as a result of the screening process.

[SME business] Outline of the "Special Loan for New Coronavirus Infections"

Who

1.Sales in the last one month have decreased by 5% or more compared to the same period of the previous year or two years ago,

2 The situaltion is similar to the same period of last year.

How to fund

Business conditions are expected to recover and develop over the medium to long term.

Use of funds Capital and long-term working capital required by social factors associated with the impact of the new coronavirus infection

Maximum loan amount

SME business: Direct loan 300 million yen (separate line item)

Interest rate (years)

Base rate (of interest),However, up to 100 million yen is the base interest rate of -0.9%(Note 2) for the first three years of the loan, and the base interest rate for the fourth and subsequent years. more information on "virtually interest-free".

Actual repayment period

Within 20 years (including a deferment period of 5 years or less)

Working capital Up to 15 years (including a deferral period of up to 5 years)

Collateral, etc.

Unsecured; interest rate review system every five years.

Apply for a loan

Direct loan, or apply at the SME business counter of any JFC branch.

[SME Business]

Documents to be submitted at the time of application for the "Special Loan for New Coronavirus Infections"

- Borrowing Application Form

- Certificate of corporate registration (for those who do not currently use the SME business)

- Seal certificate of the representative (for those who do not currently use the SME business)

- Proof of tax payment (proof of corporate tax for the last two fiscal years), proof of the amount of consumption tax not yet paid (For those who do not currently use a small business)

- Tax returns and financial statements (including statements of accounts) for the last three fiscal years.

- Documents that show recent sales

Further Requirements

- If more than six months have passed since the settlement of accounts, please submit a trial balance and other materials that allow us to understand business conditions.

- If you are in a hurry to obtain funds and need time to prepare documents, please consult with us at the time of application.

[SME Business]

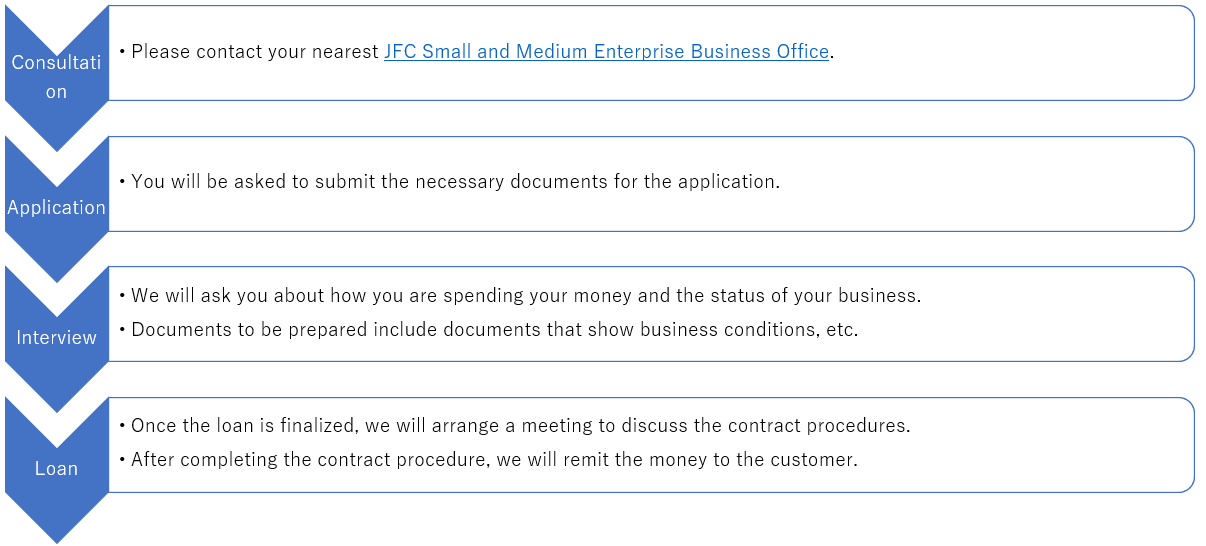

Application procedures for the "Special Loan for New Coronavirus Infections"

Industry Classification for the Definition of Small and Medium Enterprise Basic Law

Manufacturing and other industries

A company whose capital or total amount of investment is 300 million yen or less

or companies and individuals with 300 or fewer employees who are regularly employed

Wholesale Business

A company whose capital or total amount of investment is 100 million yen or less

or Companies and individuals with 100 or fewer employees in regular use

Retail Trade

Companies and individuals with less than 50 million yen in capital or the total amount of investment, or companies and individuals with less than 50 regular employees

Service Industry

Companies and individuals with less than 50 million yen in capital or the total amount of investment, or companies and individuals with less than 100 regular employees

Notes:

Currently, the government is considering a special interest subsidy system, and those who meet certain requirements can receive interest subsidies at virtually no interest for the first three years, up to 30 million yen. Please wait for a while until the details of the specific procedure for claiming the interest subsidy are made public. Please note that we may not be able to meet your wishes as a result of the screening process.

Sources:

1. http://japan.kantei.go.jp/ongoingtopics/_00015.html