The Omnibus Law brings changes to the definition of a Tax Subject. Before the Omnibus Law came into effect in November 2020, a Tax Subject individual is one who stays in Indonesia for more than 183 days within a period of 12 months. To clarify existing uncertainty, the Ministry of Finance Regulation No. 18/PMK.03/2021 (“PMK-18”) issued on February 17, 2021 provides additional requirements and procedures.

1. Clarification on Criteria for Domestic Tax Subjects

An individual is a Domestic Tax Subject if they are residing in Indonesia, present in Indonesia for more than 183 days within a 12-month period, or have an intention to stay in Indonesia. PMK-18 further elaborates as follows:

- The definition of “residing in Indonesia” is based on whether the individual

- Lives in a place in Indonesia that is at their disposal or can be accessed at all times, either owned, rented, or available to be used by the individual, and not merely a place of transit;

- Has their center of vital interests in Indonesia; or

- Has their habitual abode in Indonesia, meaning a place to carry out hobbies or activities.

- Present in Indonesia for more than 183 days within a 12-month period can be counted either continuously or intermittently, with part of day counting as 1 (one) day.

- An “intention to stay in Indonesia” can be substantiated by documents such as:

- A Permanent Stay Permit (Kartu Izin Tinggal Tetap (KITAP));

- A Limited Stay Visa (Visa Tinggal Terbatas (VITAS) with more than 183 days validity;

- A Limited Stay Permit (Izin Tinggal Terbatas (ITAS) with more than 183 days validity;

- An employment agreement with a period of more than 183 days; or

- Other supporting documents to prove the intention to stay in Indonesia, such as a rental agreement of more than 183 days, or mobilizing family members to live in Indonesia.

2. Foreign Tax Subject

An individual will become Foreign Tax Subject, if:

- The individual does not reside in Indonesia;

- The Foreign Citizen (Warga Negara Asing (WNA)) has not been present in Indonesia for more than 183 days within a 12-month period; or

- The Domestic Citizen (Warga Negara Indonesia (WNI)) has been outside of Indonesia for more than 183 days within a 12-month period, and fulfills the below requirements.

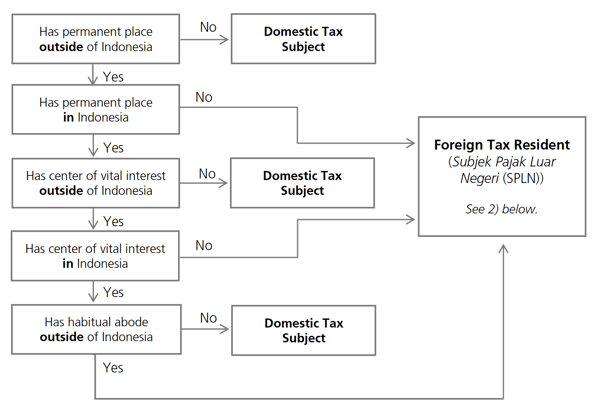

The requirements that WNI must fulfill are as follows:

- Subject to a tie-breaker rule based on the location of permanent place, center of vital interests, and habitual abode, which are analyzed on a tiered basis, as shown below:

- To fulfil the criteria as a Foreign Tax Resident (SPLN), the individual must:

- Be registered as a tax resident in that foreign jurisdiction (proven by a Certificate of Domicile); and

- Obtain a Certificate of WNI that fulfills the criteria as an SPLN from the Director General of Taxation.

Contact Us

For more information related to Indonesia’s Omnibus Law, please contact your Tricor representative.