Trusts have evolved from being instruments of guardianship to being sophisticated vehicles for estate & succession planning, and asset protection for family wealth. They also serve as a means to reward and incentivize key staff of corporations. Understanding different trust structures and utilizing them to secure your wealth will preserve it for generations to come.

Entrusting your wealth with experienced trustees

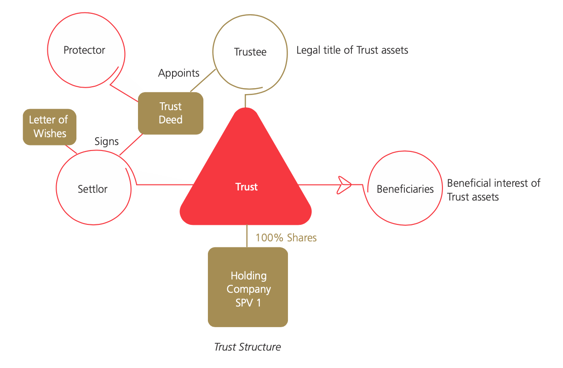

A trust is a legal relationship that enables the holder of wealth and assets (a “settlor”) to legally entrust those assets to a “trustee” to safeguard in accordance with a written legal document (a “Trust Deed”). Assets held under the trust are intended for the benefit of the “beneficiaries” both during the lifetime of the settlor, and after the settlor’s death. Trustees can be individuals or corporates (banks or independent trust companies). The trustee is responsible for administering and managing these assets according to the terms set out in the Trust Deed signed by the settlor. In some trust structures, the settlors can choose to retain the power of investment and asset management of the trust assets during their lifetime, and trustees have a more passive role. However, regardless of the trustee’s role, the trustee holds the legal title to the assets placed within the trust.

Assets that can be placed into a trust are similar to those that can be included in a Will. These include real estate, life insurance policies, stocks, shares, bank deposits, investments, cash and almost any form of asset (including antiques, jewelry, artwork, aircraft, yachts, etc.).

Choosing the right financial tool to secure family's future

Private individuals and corporates both choose to establish trusts for compelling reasons of financial security and asset protection. For private settlors, trusts go a step further than a Will and provide asset protection, both during and after the settlor’s lifetime, for the settlor’s family and descendants. When heads of families are owners of a large amount of wealth and have family members with differing circumstances and needs, a trust enables them to ensure that assets are not just safeguarded for them, but suitably distributed according to their wishes. It ensures that minor children, grandchildren, family members with disabilities or special needs, are all provided for and their future is secured. Settlors can define when and in what amounts the beneficiaries can receive their distributions, thereby ensuring that their hard-earned wealth is not squandered and is wisely utilized.

Trusts also serve to protect wealth from familial disputes and creditors’ claims, and offer an additional layer of protection to companies whose operations could be disrupted based on claims by spouses in the event of divorce or potential family heirs upon the death of the principal shareholder. Placing businesses and core assets in a trust frees up settlors to focus on managing and operating their day-to-day businesses. Many people also set up trusts to ensure that their philanthropic causes are implemented and continue to be supported after their passing.

Corporate trusts on the other hand are primarily an instrument for companies to attract, incentivise and reward their key employees in the form of Employee Benefit Trusts (“EBTs”). EBTs are a great tool to hold company assets in a trust, thereby entrusting legal ownership of those assets to the trustee. These assets typically include cash and shares. The trust outlasts the company and its ownership and thereby protects the stock options granted to both present and old employees.

Understanding the differences between Wills and Trusts

| Wills | Trusts | |

| Succession planning | Through a will anything under your name legally can be passed on to your legal heirs. This is however in the event that the will is not contested. The cost is one time. | You have the guarantee that your wealth is secured and passed on according to your wishes, during your lifetime and after. However only specified assets will be passed on. You have to pay fees for maintenance of trusts. |

| Probate | Assets will be settled by probate court after death, and processes can last anywhere between six months to two years. | Trusts are not subject to lengthy probate processes and assets can be passed on without court. |

| Legal disputes | Wills can often be contested and also invalidated. Claims and disputes may be made by family members, business partners, and creditors. This also adds huge costs in legal fees. | Trusts are legally firm and clear about the beneficiaries and their proceedings. They can also avoid family disputes over a deceased person’s estate. |

| Protection for minor children | If you pass away prematurely, a court may appoint a guardian for your children, and they will also be responsible for guarding their inheritance. The risk of poor management runs high. There may also be claims made against your wealth. | Trusts for each of your children will ensure that they are provided for, have financial security, and their interests are properly protected. Oftentimes children who come by a large volume of wealth at the age of inheritance (eighteen) may not have the maturity to handle and preserve their inheritance. This can be countered by specifying an age of inheritance for the trusts which can be higher than the legal age of inheritance. |

| Creditor protection | Wills are placed in the public domain. Claims can be made against your assets by creditors. | Assets held within a trust cannot be claimed by creditors of either the settlor or the beneficiaries (but subject to relevant insolvency claw back laws). Moreover, trusts are private. |

Understanding different trust structures and choosing the right one

There are various types of trusts, and each is designed to meet different needs.

| Trust Type | Description |

| Offshore Trust | Trusts set up in off-shore jurisdictions offer increased asset protection and confidentiality. |

| Discretionary Trust | A fully discretionary trust where the trustee has complete control over the management and distribution of the trust funds at its discretion. Suitable where the settlor is not able to, or does not wish, to have any control over the investment and asset management of the trust fund for any particular reason, such as tax considerations. |

| Employee Benefit Trust (“EBT”) | An employee incentive scheme or plan where company shares are held in a trust to be awarded to employees upon satisfaction of certain conditions, such as remaining with the company for a certain number of years or meeting certain KPIs. |

| Foreign Grantor Trust (“FGT”) | A trust commonly used for non-US settlors and non-US sourced assets with US Persons as beneficiaries. A foreign trust status in the US is determined by the tax residency of the settlor and where the trust is administered, and thereby impacts taxation on the trust fund and US Person beneficiaries. An FGT can mitigate US tax if properly structured and administered. |

| Private Trust Company (“PTC”) | A Private Trust Company is established with the sole purpose of acting as a trustee for a multiple group of family trusts and consolidating their management with the same benefits as that of a traditional trust. A PTC allows the settlor and family members to be directors on the board, thereby enjoying greater control over the Trust and the Trust Fund. |

| Pre-IPO Trust | A trust that holds shares in a company that is to be publicly listed on a stock exchange, which the settlor wants to retain for the benefit of him/herself and his/her family after the company lists. |

| Reserved Power Trust | A trust where the settlor reserves control over certain powers in comparison to fully discretionary trusts where the trustee holds all the powers. It is commonly used to allow the settlor to keep the power to make investment decisions over the trust assets. He or she can also appoint an investment manager. |

| Stand-by Trust | A living trust established during a settlor’s lifetime and activated by pre-determined trigger events like physical disability, illness, disappearance, or death. It is most commonly used to receive lump sum life insurance policy proceeds upon the death of the life insured. |

| BVI VISTA Trust | A special type of BVI trust that allows the settlor complete control over the underlying BVI holding company under the trust, as sole director or to appoint the board of directors, and thereby control the management of the underlying trust assets. This type of trust is commonly used to hold operating or trading companies. |

| Cayman STAR Trust | A special type of Cayman trust that allows the beneficiaries to be a mixture of people and purposes (such as charitable causes). |

Make the right choice

Before you decide to set up a trust, it is crucial to establish your goals and determine the type of trust(s) and jurisdiction that best suit your needs. Understanding different trust structures, different jurisdictions, and what they have to offer, will help you ensure that you have protected and secured your assets in the best possible way.

An established and experienced trust partner can help determine the right structures and help select a suitably flexible trust a to ensure the right balance between control over the trust assets and the degree of asset protection over the trust assets, during and after the settlor’s lifetime. Choosing the right jurisdiction can also significantly impact whether placing your assets in a trust brings you benefits or constraints. Offshore destinations like the British Virgin Islands (“BVI”) and Cayman Islands, are popular with corporates and individuals alike.

With amendments to the trust law in 2013, Hong Kong is now also an attractive jurisdiction for trusts, offering significant advantages including an indefinite perpetuity period, simple tax laws, and greater control over the investment and asset management of trust assets by settlors. Companies too may find great benefit in establishing Employee Benefit Trusts with a reputable and experienced trust company to attract, retain, incentivise and motivate their key employees.