- Business Advisory

- Accounting & Financial Reporting

- Tax Services

- Treasury & Payment Administration

- Fund Administration

- Governance, Risk & Compliance

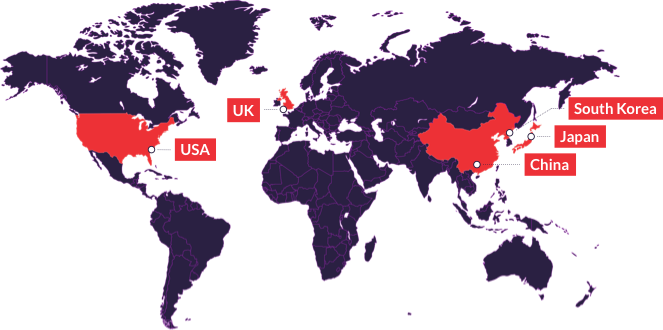

Australia is one of the most exciting places to expand your business. As the world’s 13th largest economy, it plays an integral role in many major economies across Asia, Europe and North America. By opening up a company here, you can tap into its highly-skilled workforce and abundance of natural resources — all of which have contributed to 27 years of consecutive economic growth.

Looking to expand your business here? Let Tricor Australia help you navigate through Australia's unique taxation rules, regulations, and business customs.

Key Trading Partner

Growth Opportunities

-

Agribusiness & Food

-

Tourism Infrastructure

-

Advanced Manufacturing, Services & Technology

-

Major Infrastructure

-

Resources & Energy

Tricor Australia offers a holistic service that's able to facilitate all the financial and legal needs of its clients, even where the service is outside the scope of our normal offerings.

We proactively maintain close, long-term relationships with our clients — promoting regular contact that facilitates better understanding and allows us to create customised solutions for our clients.

Our team features staff members with over 5, 10, 15 and 20 years of service with the company. They are highly-qualified and experienced, and are dedicated to providing a long continuity of service.

The steps and requirements will differ depending on the type of entity you choose. However, this is the process we typically take our clients through:

1. Choose the right company type

The pros and cons of each type of business in terms of liability, scrutiny and taxes. However, the type of company you choose should be based on your own unique circumstances.

2. Apply for an Australian Business Number (ABN)

An ABN is a 11-digit number that identifies your business to the public, the Australian Taxation Office (ATO) and other government agencies. Once you have acquired one, you'll be able to register your business name, identify yourself to other businesses when making transactions and register an Australian domain name. It is also required when registering for Goods and Services Tax (GST).

3. Register your business/company name

This can be done at the same time as the ABN registration. Whether you need a business name or a company name (including Australian Company Number) will depend on the entity type you have chosen.

4. Apply for the appropriate tax registrations

All businesses need a tax file number (TFN), but depending on your company type, you may need to apply for the following tax registrations:

Whether you are starting a new business in Australia, or operating a branch of an existing foreign entity, if you or other colleagues wish to relocate to Australia, a valid Australian visa is needed. While it’s possible to enter Australia on provisional visas for the purpose of visitation or business (not work), eventually, you’ll still need the correct visa. These are the two types Tricor Australia normally recommends to our clients:

Business Innovation and Investment Visa (Subclass 188)

This visa allows you to own and manage your business in Australia, conduct business & investor activities or undertake any entrepreneurial activity in Australia. The length of stay for this visa is usually 4 years and 3 months unless otherwise specified.

After satisfying relevant qualifying periods, subclass 188 visa holders can be granted permanent residence visas (subclass 888).

Business Talent Visa (Subclass 132)

This visa allows you to establish a new or develop an existing business in Australia. The length of stay for this visa is indefinite, it’s, therefore for all intents and purposes, a permanent visa.

Simply being aware of regulations and standards can save a lot of trouble in the future. Australia takes employee welfare seriously, and as a result, is strict when it comes to employment law. Tricor Australia can help you understand employee expectations and comply with the following standards set by the Australian government:

Fair Work Act 2009

The Fair Work Act 2009 is the primary piece of legislation that governs all workplaces in Australia, and serves as the foundation to all employment standards and regulations. The Act provides the terms and conditions of employment, the rights and responsibilities of different parties in regards to employment, as well as the compliance enforcement of the Act.

National Employment Standards (NES)

The National Employment Standards (NES) serves as a safety net of minimum terms and conditions for employers and employees. It creates a baseline for areas such as: hours of work, the right to request flexible working arrangements, holidays, various types of leave, notice of termination and redundancy, and more.

National Minimum Wage

National Minimum Wage is the base rate employees are entitled to for ordinary hours of work. Every year, this is reviewed by the Fair Work Commission (FWC) based on submissions from organisations and individuals, as well as consultations before and research commissioned by the Expert Panel. A national minimum wage order will be made after the review has been concluded and will be applied from the first full pay period on or after 1 July every year.

Australian businesses must lodge a Business Activity Statement to the Australian Taxation Office (ATO) to make payments and report tax obligations. Regardless whether the company is incorporated or unincorporated, it will be subject to Double Taxation, of which the U.S., China and Canada, among other countries has an Agreement.

In addition, you'll need to determine your residency status for personal income tax purposes. Whether you're considered an Australian resident, a foreign resident or a temporary resident will determine what income you must declare, as well as your tax rate. Depending on your status, there may also be tax exemptions you can take advantage of or tax treaties need to be adhered to. Tricor Australia can assist in working out these details.

For reference, here are the current tax rates for Australian residents and foreign residents (excluding the 2% Medicare levy):

|

Taxable income |

Tax on this income |

|---|---|

|

0 – $18,200 |

Nil |

|

$18,201 – $37,000 |

19c for each $1 over $18,200 |

|

$37,001 – $90,000 |

$3,572 plus 32.5c for each $1 over $37,000 |

|

$90,001 – $180,000 |

$20,797 plus 37c for each $1 over $90,000 |

|

$180,001 and over |

$54,097 plus 45c for each $1 over $180,000 |

|

Taxable income |

Tax on this income |

|---|---|

|

0 – $90,000 |

32.5c for each $1 |

|

$90,001 – $180,000 |

$29,250 plus 37c for each $1 over $90,000 |

|

$180,001 and over |

$62,550 plus 45c for each $1 over $180,000 |

Tricor Services in Australia

Business Services in Australia

Corporate Services in Australia

- Entity Formation & Business Establishment

- Corporate Governance, Compliance & Secretarial

- Listed Issuer & Named Company Secretary Services

- Trust & Fiduciary Services

- Fund Secretarial & Compliance

- Process Agent & Escrow Agent

- Due Diligence & Corporate Health Check

- Liquidation, Dissolution & Cessation of Business

-1.png)